Home

chiefjudgetrumbo.com

Twenty-fifth Judicial Circuit Court of Virginia

in Highland County

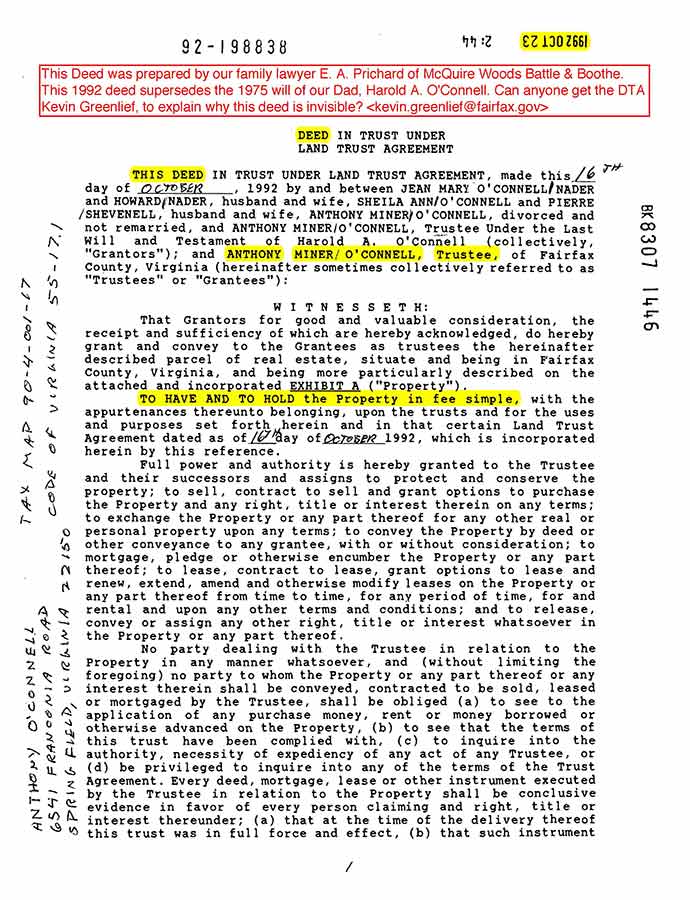

A lien for back taxes on a property in Fairfax County, Virginia, was sent to Highland County, Virginia. It is is against the law in multiple ways and shrouded in secrecy. It is so secret the property it is placed against remains unknown. Those in control pretend the lien is against assets in the Blue Grass Bank and then pretend it is against assets at the First Citizens Bank, and then pretend they do no work in Highland County. I had no assets in either bank.

To see for yourself if the lien amount is a made up number that can be changed in any way at any time for any reason, regardless of law or math, ask how they arrived at their lien amount of $27,718.72 as of July 26, 2012. As of the end of 2010, the Trust owed me $127,290.17 because I paid the real estate taxes for all the beneficiaries until I ran out of money.

The only significant property I own in Highland County is 77 acres of real estate. This suggests that the real target is this 77 acres. Covertly planting an obstacle in a title trail and keeping it a secrect is a pattern. It obstructs the landowner from selling his property and makes it appear as the landowner's fault. It transfers control of the property from the landowner to those who control the obstacle. www.canwelookattheevidence.com/fix/fix-home.html

(Below four pages) Why is the lien trail concealed? On what property is the lien placed against?

What is the lien trail?

(Below three pages) Why is the Deed that says "The Trustee shall have no individual liability or obligation

whatsoever " not recognized?

(Below four pages) Is it a coincidence that the lien from Chief Judge Dennis J. Smith's Court's law firm and the Phoenix VA's letter notifying me that my application for the VA's poverty pension is virtually buried in ambugity and confusion were sent at the same time (May 10-11, 2012)? Like a one two punch? Can we look at the evidence? The evidence is in exposing the trails. Attacking my character is cover, not evidence. Where are all the politicians who say they support veterans?

http://www.659trail.com

http://www.alexandriavirginia15acres.com

http://www.book467page191money.com

http://www.book8307page1446deed.com

http://www.canweconnectthedots.com (Best reference)

http://www.canwelookattheevidence.com

http://www.chiefjudgesmith.com

http://www.chiefjudgetrumbo.com

http://www.farm139.com

http://www.fbispringfield.com

http://www.followthetrails.com

http://www.followthetrails2013.com

http://www.inreharoldaoconnell.com

http://www.judgesfairfaxcounty.com

http://www.removethesecrecy.com

http://www.stoppedmedicine.com

http://www.tucsonva.com (How big and protected are they?)

http://www.unknownlien.com

Optional

Jean Miner O'Connell, our Mother, did not want assets to disappear from her estate or her family torn apart to cover it up. The CPA Joanne L. Barnes (SN 579-44-3240, EIN 541040148?), the Attorney Edward J. White, and their collaborators, did that. Their signature cover is to use a trusting member of the family they victimize to unwittingly divide and disempower the family. They are insulated beyond imagination.

It appears to be the perfect cover. In 25 years, since I wrote the Bar in 1992, not one member of the establishment has tried to expose their accounting or tried to stop them from using our trusting sister. Not one. This accounting fraud is here to stay, and the only protection familes have is themselves. Secrecy between family members is fatal to the family and essential to the fraudsters. If your family insists on no secrecy between family members the fraudsters will leave your family alone.

This is how the protected lawyer-CPA team makes $518,903.26 disappear and tears your family apart to cover it up. Use the accounting trail $545,820.43 - $26,917.17 = $518,903.26 as a bench mark. You can always trust that $545,820.43 - $26,917.17 = $518,903.26. If hundreds or a thousand people attack your character, as if character assasnation were evidence and not cover, $545,820.43 minus $26,917.17 still equals $518,903.26. chiefjudgesmith.com/518903tw/518903-transcripts-11webs.html

Virginia Senator Mark Warner twitter.com/_/status/864890758867943424

Neil deGrasse Tyson facebook.com/neildegrassetyson/videos/10155195888806613/

|